Online Dystopia, il nuovo exchange Polygon

Finalmente Sphere Finance, da alla luce il suo primo progetto come promesso.

Nel rispetto dei tempi, secondo roadmap, arriva Dystopia, il DEX su rete Polygon, che consentirà agli investitori in $Sphere di beneficiare delle revenue dell’exchange.

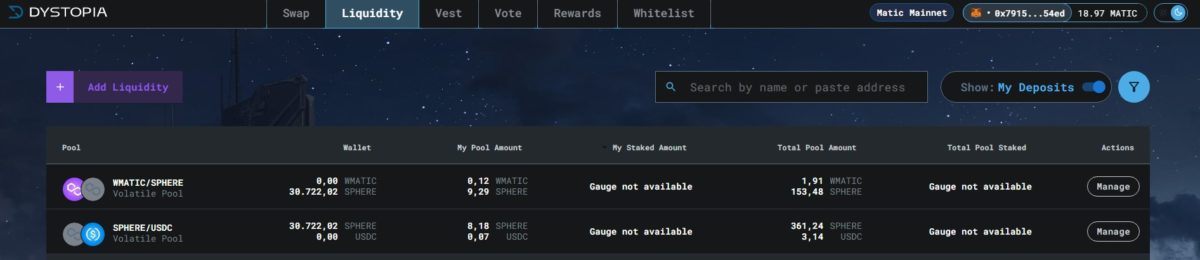

Sono già state create le prime pool di liquidità. Io ho avuto l’onore di creare le prime coppie WMATIC/SPHERE Volatile e SPHERE/USDC Volatile, ma chiunque può già entrare nel sito ufficiale e iniziare a versare la propria liquidità, che verrà remunerata tra 14 giorni a partire da oggi.

Infatti le prime 2 settimane verranno utilizzate come rodaggio per questo DEX ve(3,3), che è una vera e propria rivoluzione per la blockchain di Polygon.

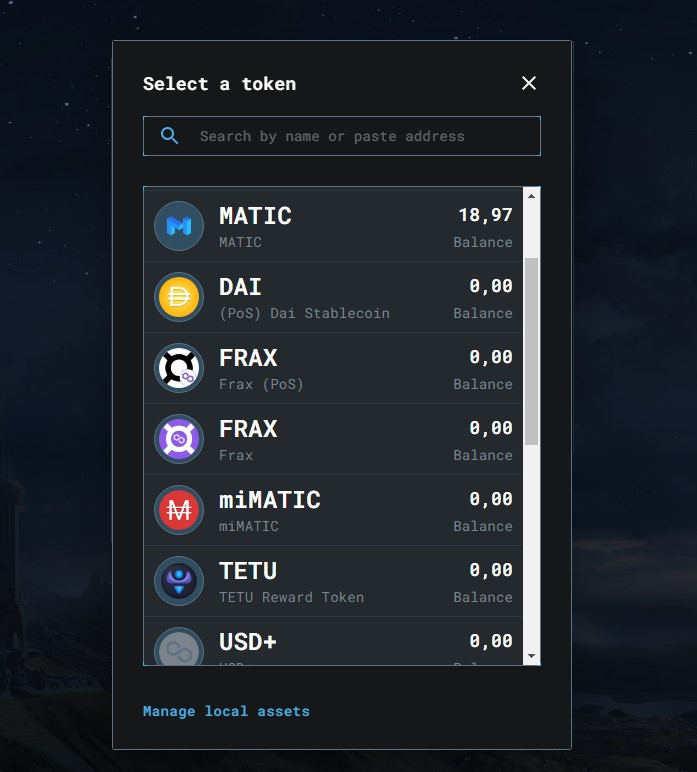

Lo Swap

E’ già possibile swappare tutte le valute inserite nelle varie pool, chiaramente in relazione alla disponibilità, che i primi giorni sarà piuttosto scarsa, ma sono certo che in poche settimane ce ne sarà per tutti.

Le commissioni sono le più basse dell’intero ecosistema, ma garantiscono lo 0.05% ai fornitori di liquidità su ogni swap per la coppia fornita.

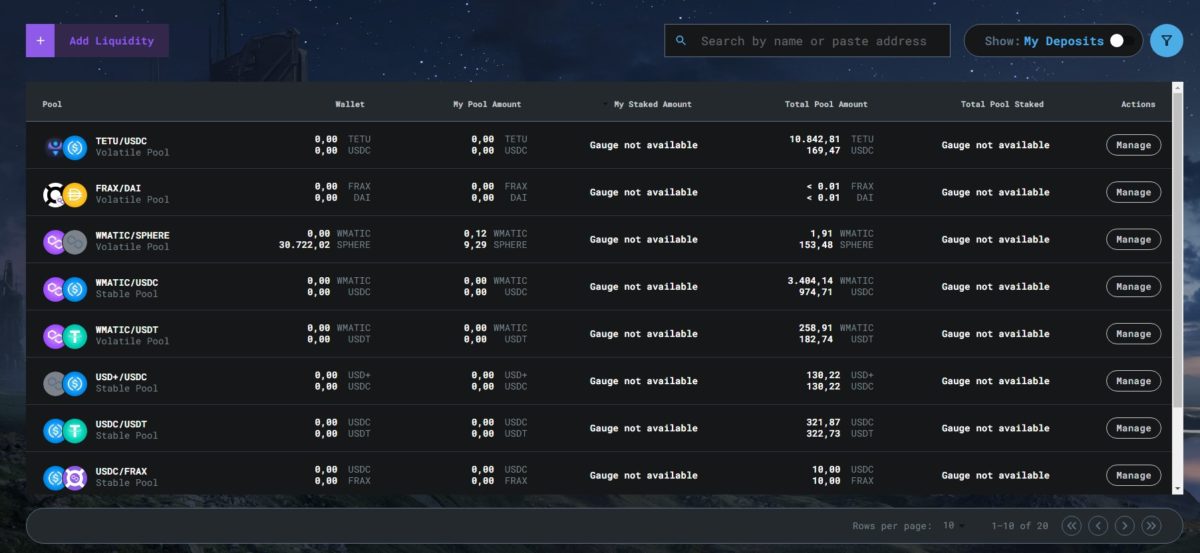

Liquidity Pool

Le liquidity pool come accennavo, si stanno già formando, ma è possibile creare qualsiasi coppia di coin o token, disponibili sulla rete Polygon, sia in versione Stable, che Volatile.

Non ci sono minimi di prelievo.

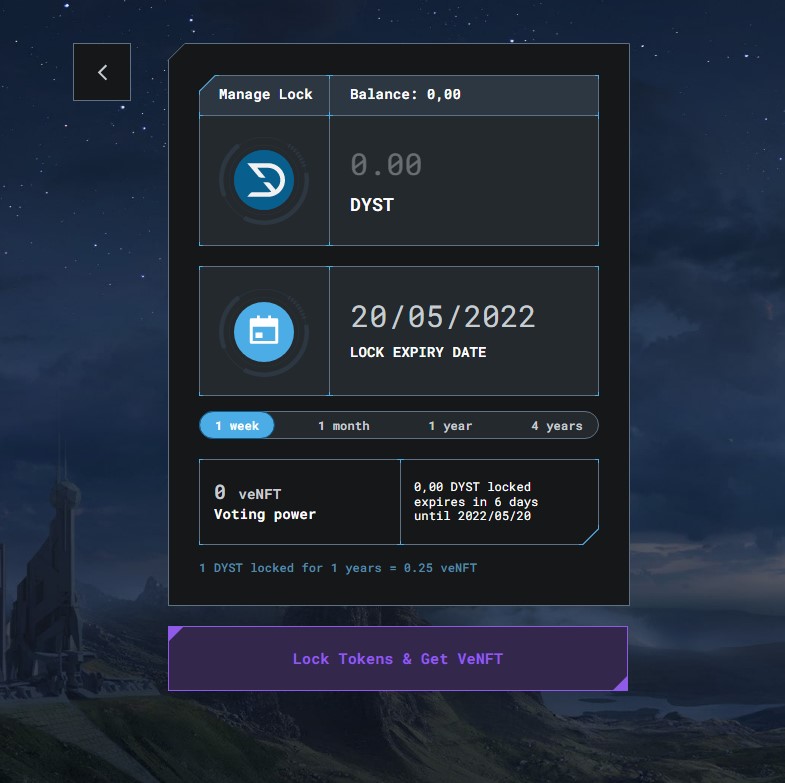

Il Vest

Le reward generate dalla fornitura di liquidità saranno in $DYST, il token di governance del protocollo, che sarà possibile lockare in Vest per una settimana, un mese, un anno o 4 anni.

Questa operazione consentirà di accumulare veNFT e di conseguenza più potere di voto, ma ovviamente, per capire meglio il meccanismo, vi rimando al Medium ufficiale per qualsiasi approfondimento.

Ci sono anche funzionalità come il Bribe, il Vote e la Whitelist per gli NFT, ma sono al momento così primordiali che ci vorrà un po’ per capirne lo use-case.

Quello che so è che tutto quello che riguarda il mondo Sphere Finance è davvero affascinante e agli inizi, per cui se ti interessa puoi approfondire sul server Discord di Sphere o direttamente in quello di Dystopia